Understanding KYC Verification in Online Casinos

Introduction

When signing up at trusted online casinos like 96M, you’ll often encounter the term KYC Verification. KYC stands for Know Your Customer, and it’s a mandatory process designed to protect both the casino and its players. While some may find it inconvenient, KYC is essential for building a safe, secure, and transparent gaming environment.

In this guide, we’ll explain what KYC means, why it matters, how the process works, and what Malaysian and Singaporean players should prepare before playing.

What is KYC Verification?

KYC verification is a compliance process where an online casino confirms your identity, age, and financial details before allowing deposits, withdrawals, or bonus claims. It prevents fraudulent activities such as:

- Underage gambling.

- Multiple accounts or bonus abuse.

- Money laundering or suspicious transactions.

Simply put, KYC ensures that only real players with valid identities can enjoy the casino safely.

Why KYC is Important for Players

Many players in Malaysia and Singapore wonder why casinos require personal documents. The truth is, KYC brings multiple benefits:

- Security for Your Funds – By verifying your identity, casinos ensure that no one else can access your winnings.

- Regulatory Compliance – Licensed casinos (such as those under Anjouan, Malta, or Curacao regulations) must comply with anti-money laundering laws.

- Fair Gaming – It keeps the platform free from bots, fake accounts, or unfair play.

- Trust Factor – Casinos that follow KYC rules show they operate transparently, giving you confidence in their legitimacy.

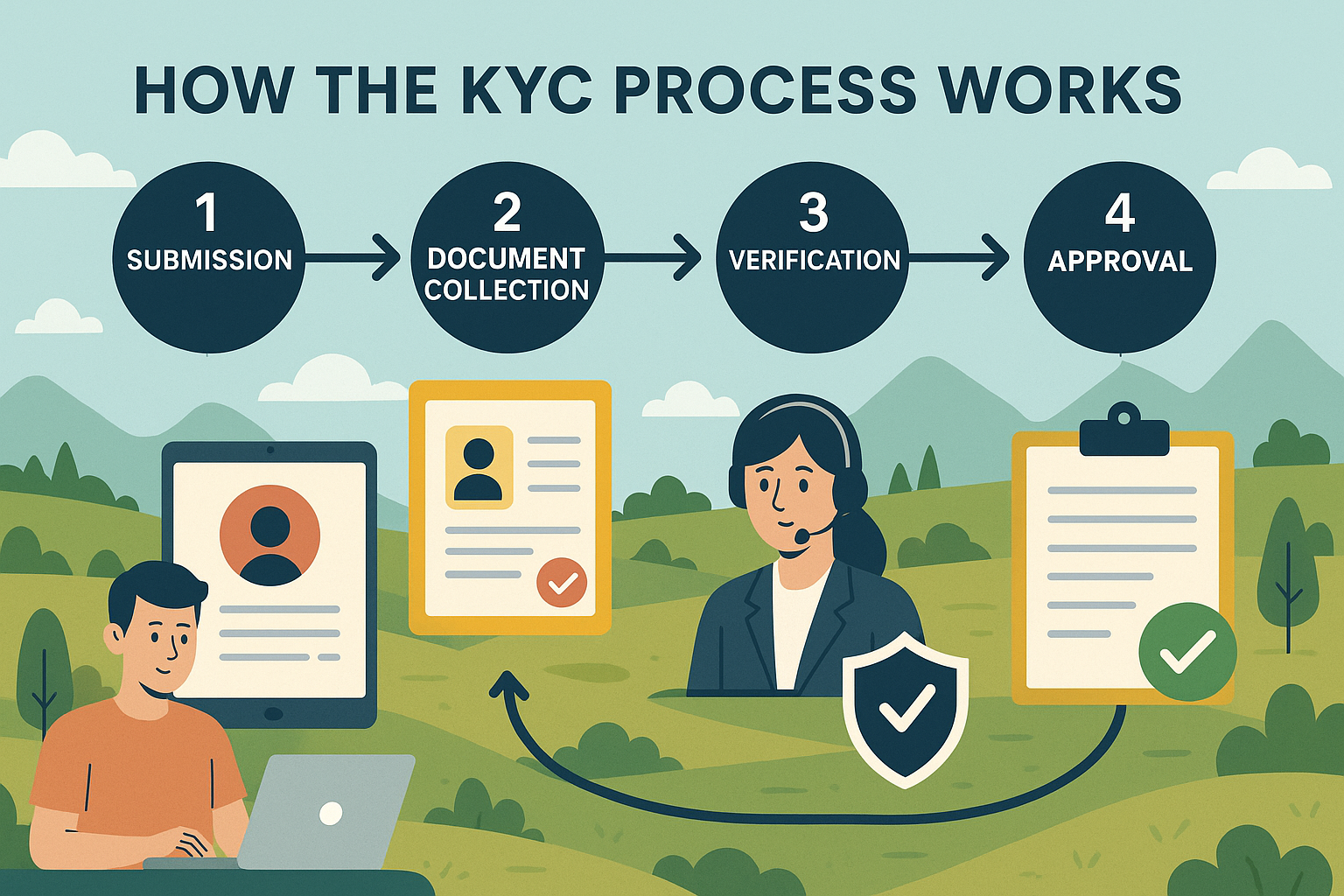

How the KYC Process Works

The steps may vary slightly between platforms, but generally, players at 96M and other reputable casinos will need to:

- Submit Proof of Identity – A government-issued ID (passport, NRIC, or driver’s license).

- Provide Proof of Address – A utility bill, bank statement, or official document showing your name and address.

- Verify Payment Method – A screenshot or statement showing your e-wallet or bank account belongs to you.

- Selfie or Live Verification – Some casinos may ask for a quick photo holding your ID to confirm it matches your profile.

Tips for Smooth KYC Approval

To avoid delays when withdrawing your winnings, here are some tips:

- Ensure your ID documents are clear and not expired.

- Match your casino account details with your legal documents.

- Use the same payment method for deposits and withdrawals.

- Complete KYC as early as possible—ideally right after registration.

Common Concerns from Malaysian & Singaporean Players

- Privacy – Licensed casinos use SSL encryption and store documents securely.

- Speed – Most verifications are completed within 24–48 hours.

- Rejections – Usually due to blurred photos, mismatched details, or outdated documents.

Conclusion: KYC is Your Security Net

KYC verification may feel like a hurdle at first, but it’s actually your best protection as a player. By ensuring only verified users can access deposits and withdrawals, casinos like 96M create a safer betting environment for everyone.

If you’re planning to start your journey at 96M or any licensed platform, completing KYC early ensures faster withdrawals, smoother gameplay, and peace of mind.